The S&P 500 Achieves Its Highest Close in About 4 Months

Market News Summary

European stocks closed higher at the end of Monday’s trading, extending gains from a robust week fuelled by growing expectations of interest rate cuts. The STOXX 600 European index edged up by 0.1%, building on its approximately 3% surge the previous week. Throughout this period, markets factored in anticipated interest rate cuts of 100 basis points by 2024, commencing with the initial cut in April. Nevertheless, officials from the European Central Bank refrained from sharing this optimism, citing persistently high inflation.

On Wall Street, Nvidia shares closed on Monday, November 20, up by 2.3% at a record high of $504.20. These gains come ahead of the company’s third-quarter financial results announcement on Tuesday, with analysts expecting revenue growth of over 170%.

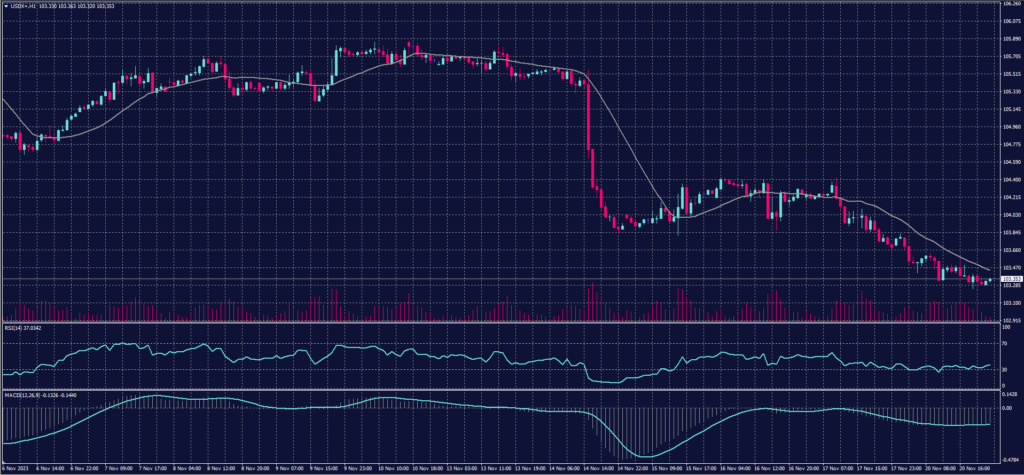

Dollar Index (USDX)

Investors are eagerly anticipating the minutes of the Federal Reserve’s meeting on Tuesday, November 21, hoping to gain insights into policymakers’ decisions regarding interest rates and to understand what it might take to alter the course in the future.

Data from federal funds futures pricing indicates an almost 100% probability that the Federal Open Market Committee will keep interest rates unchanged at its upcoming meeting in December.

Pivot Point: 103.45

| Resistance level | Support level |

| 103.70 | 103.10 |

| 104.05 | 102.85 |

| 104.65 | 102.30 |

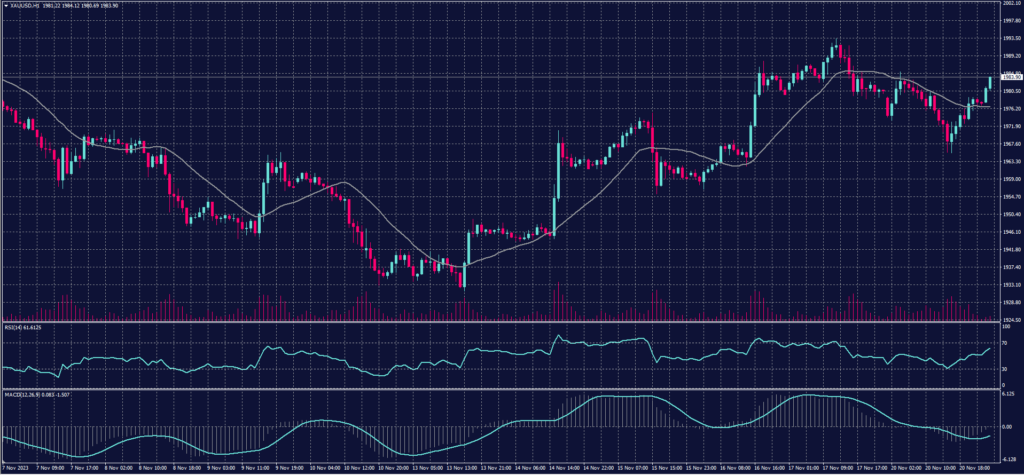

Spot Gold (XAUUSD)

Gold prices fell on Monday, following a decline in the dollar, setting a new low for prices as investors awaited the minutes of the latest Federal Reserve meeting for signals on the trajectory of U.S. interest rates.

However, this decline at Monday’s close did not persist during the Asian session, as gold is now trading higher, supported by upward momentum at $1989 per ounce.

Pivot Point: 1975

| Resistance level | Support level |

| 1986 | 1966 |

| 1995 | 1956 |

| 2006 | 1947 |

Dow Jones Index (DJ30ft – US30)

The U.S. indices closed with strong collective gains in Monday’s session, supported by a decline in the dollar and Treasury bond yields, in addition to the stellar performance of Microsoft stock after the company appointed prominent executives in the field of artificial intelligence.

The Dow Jones index rose by about 0.55%, equivalent to 191 points, closing above the 35,100 level for the first time in 3 months. The Nasdaq index rose by 1.1%, and the S&P 500 index also increased by about 0.7%, marking its highest daily close in about 4 months.

Pivot Point: 35155

| Resistance level | Support level |

| 35355 | 35020 |

| 35485 | 34825 |

| 35685 | 34692 |

US Crude Oil (USOUSD)

Oil prices rose at the close on Monday, November 20, by more than 2%, amid expectations of an increase in production cuts by OPEC+ next week.

Brent crude futures rose 2.1% after the close, equivalent to $1.71 per barrel, reaching $82.32 per barrel. West Texas Intermediate crude also rose after the close, reaching $77.60, an increase of $1.71 or 2.3%.

Pivot Point: 77.15

| Resistance level | Support level |

| 78.85 | 75.85 |

| 80.15 | 74.10 |

| 81.85 | 72.80 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.